The Iraqi Dinar is the currency of Iraq. The National Bank of Iraq is responsible for circulating the Iraqi dinar. It contains approximately 1,000 fils. In the second quarter of 2022, the Iraqi dinar’s conversion scale is $1 = 1,450 IQD. The Iraqi dinar was introduced in 1932. Iraqi dinar trading rates were stable until the 1990s. Rates after 1990 were 3,000 IQD per USD. Rates improved by 2003. Until recently, it remained at 1,190 IQD per USD. The National Bank of Iraq changed currency rates in December 2020. Rates became $1 = 1,310.278325 IQD and remained high until 2025.

History of the Iraqi Dinar

The Iraqi dinar was introduced into circulation in 1932 and replaced the Indian rupee, which had been public cash since the British occupation in the Second Great War. The Iraqi dinar remained pegged to the English pound until 1959, after which it was pegged to the US dollar at 1 IQD = 2.80 USD, without significant value adjustment.

The Iraqi dinar did not follow the downgrading of the US currency in 1971 and 1973, and the value of the IQD rose to 3.38 USD before falling to 3.22 USD due to a 5% decline. The rate continued until the Gulf conflict. However, in late 1989, the market rate of illicit liquor was several times higher. From this, we hope that the future predictions of the Iraqi Dinar will be in favor of the Iraqi Dinar in 2024 and the revaluation of the Iraqi Dinar in 2024 will go in a positive direction.

What is the Iraqi Dinar?

As everyone knows, the Iraqi Dinar is the currency of Iraq. The Central Bank of Iraq is in charge of circulating the Iraqi Dinar. It is believed to be made up of approximately 1,000 files. In Q2 2024, the Iraqi Dinar exchange rate is $1.55 = 2,024 IQD. The Iraqi dinar emerged in 1932. In 1959, it was pegged to the US dollar with a value of more than $3. Their exchange rates were stable until the 1990s.

After 1990, the rates became 3,000 IQD per USD. By the year 2003, its rates improved slightly. The Central Bank of Iraq changed currency rates somewhat in December 2020. Rates shifted to $1 = 1,310.278325 IQD and remain in pl

Let’s take a closer look at historical performance indicators of Iraqi Dinar:

| Year | Event | Exchange Rate |

| 2003 | Iraq War and regime change | 1 USD = 2,000 IQD |

| 2008 | Global financial crisis | 1 USD = 1,200 IQD |

| 2014 | Rise of ISIS and oil price decline | 1 USD = 1,200 IQD |

| 2016 | Economic reforms and oil price recovery | 1 USD = 1,166 IQD |

| 2020 | COVID-19 pandemic impact | 1 USD = 1,450 IQD |

Reference: Iraq’s currency faces many challenges due to war support

Iraqi Dinar Future Predictions for 2025 and 2030

It’s time to learn about the Iraqi Dinar’s future predictions for the years 2024, 2025 and 2030 now that you have a better understanding of the patterns that the Iraqi Dinar has followed in the past. After that, you will be able to plan to buy Iraqi Dinar according to the following forecasts for the Iraqi Dinar in the years 2025 and 2030:

- Impact of high oil prices on the Iraqi dinar

The future prediction of the Iraqi dinar mostly depends on the performance and stability of Iraq’s oil sector. Fortunately, projected oil prices for Iraq in 2022 and beyond are higher than projected prices for 2020. The estimated Iraqi dinar value for oil in 2025 is $39.50 per barrel. Current rates are 23.4% higher than those proposed in Iraq’s 2020 budget. As a result, this could increase the value of the Iraqi Dinar in the global market. Past fiscal challenges facing Iraq may also reduce growing oil revenues. It has the potential to ultimately increase the value of the Iraqi Dinar.

- Iraqi dinar value rises due to expansion in oil reserves

The Iraqi economy is experiencing steady expansion due to the contribution of its energy sector. The country has vast hydrocarbon reserves. However, oil has been extracted from only a negligible portion of its potential sites. Many places with oil resources still need to be discovered. Iraq has the potential to attract many international investors once it begins extracting its hydrocarbon reserves. Iraq continues to export substantial quantities of petroleum to many countries every month. Future forecasts for the Iraqi dinar indicate its value will increase after Iraq discloses any potential hydrocarbon sites. Furthermore, the value of the Iraqi dinar is likely to remain the same due to the diverse revenue streams derived from the country’s natural resources. The global need for gas and oil is unlikely to decline for years. Iraq can maintain its oil supply position and become stronger in the future. Additionally, historical trends indicate that Iraq has the potential to develop into a global energy superpower. All these elements could contribute to the appreciation of the Iraqi dinar.

- More government reforms to promote new businesses

The Iraqi government is expected to implement further reforms to stimulate the economy. The reforms could increase the value of the Iraqi dinar upon effective implementation. The reforms’ main focus was on Iraq’s gas, electricity and energy industries. Furthermore, the government intends to implement the reforms diligently. Sectors that fail to comply may face potential consequences. Another reform recommendation is that Iraq increases its oil production after the current OPEC+ agreement expires. The deal expires in April 2025. If Iraq’s oil production increases after this period, the country’s economy could experience growth.

Additionally, the Iraqi government has accumulated substantial cash reserves and gold bullion. Having such contingent reserves reduces the possibility of depreciation in the value of the Iraqi dinar. If you think the Iraqi Dinar’s future prediction for 2025 is profitable, consider buying it. Due to the abundance of natural gas and hydrocarbon reserves in Iraq, a depreciation of the Iraqi dinar is unlikely. The outlook for the Iraqi dinar in 2030 appears optimistic. Market and price analysts prepare future forecasts of the Iraqi Dinar to understand the market trend.

Current Economic Indicators of Iraqi Dinar

Iraq is also one of the most oil-dependent countries in the world. Over the past decade, oil revenues have accounted for more than 99% of exports, 85% of the government budget and 42% of gross domestic product (GDP). This excessive dependence on oil exposes the country to macroeconomic instability, while budget strictures restrict fiscal space and any opportunities for countercyclical policy. As of January 2021, Iraq’s unemployment rate of 40.2 million was ten percentage points higher than its pre-COVID-19 level of 12.7 percentage points. Unemployment has increased among migrants, returnees, women seeking jobs, self-employed before the pandemic and informal workers.

| Indicator | 2022 Data |

| GDP Growth Rate | 3.5% |

| Inflation Rate | 2.1% |

| Foreign Exchange Reserves | $60 billion |

Factors affecting the value of IQD

Many factors affect the value of IQD in the Forex market. It is essential to understand these factors to make accurate predictions for the future of the Iraqi dinar:

1. Political Stability: Iraq’s political stability plays a vital role in determining the value of its currency. Any political unrest or instability could negatively impact investor confidence and cause depreciation of the IQD.

2. Oil Prices: Iraq is one of the world’s largest oil producers. Therefore, fluctuations in global oil prices can substantially impact the value of IQD. Higher oil prices generally increase Iraq’s revenues, strengthening its currency.

3. Economic Reforms: The government of Iraq has implemented various economic reforms to diversify its economy and reduce its dependence on oil. These reforms, including attracting foreign investment and improving infrastructure, could strengthen the IQD.

4. Geopolitical Factors: Iraq’s geopolitical situation also affects the value of IQD. Any conflict or tension in the region could impact the country’s economy and currency.

Forecast for the future of Iraqi Dinar IQD 2025-2030

Given the above factors, it is necessary to consider both short-term and long-term predictions for IQD.

- Short-term forecast for IQD:

In the short term, the value of IQD is likely to remain volatile. Political instability, ongoing conflicts and global economic uncertainties may hinder its progress. Forex traders should closely monitor geopolitical developments and economic indicators to make informed decisions.

- Long Term Forecast for IQD:

In the long run, the value of the Iraqi dinar has the potential to increase. The country’s vast oil reserves, economic reforms and ongoing reconstruction efforts could contribute to its economic growth. Additionally, as Iraq stabilizes politically and attracts foreign investment, investor confidence in IQD may increase.

However, it is essential to note that recalibration of IQD is a complex process that requires significant improvement in the country’s overall economic and political situation. Therefore, any predictions for the long-term future of IQD should be taken with caution.

1 year USD/IQD Forecast: 2254.98 * 5 year USD/IQD Forecast: 7742.88 * Reference: Forecasts

Iraqi Dinar Future Projection and Prospects

With oil savings, Iraq could rebound and become a stable economy. It figured out how to do this after the eight-long Iran-Iraq war. Nevertheless, it will require an organized and promising business environment to create supportive financial certainty, which will, thus, help revive its economy and bring the IQD forex rate back to less discouraging levels. On the opposite side of the coin, signs show that the Iraqi dinar speculation is just an advertised trick. The most apparent important factor is that IQD exchanges operate in an actual “forex underground market” rather than through traditional banks and exchange desks. Furthermore, some false claims are intensely publicized by propagandists of Iraqi dinar future predictions and venture plans.

Revaluation: Revaluation of the Iraqi dinar is a scheduled change made on an accurate swapping scale against a country’s chosen standard, such as gold or the US dollar. Following the revaluation of the Iraqi dinar, the money becomes expensive compared to base cash by a change factor, and the cycle after that reverses the purchasing effect of that money.

Revaluation occurs when a higher spread level occurs by making older higher-value notes equivalent to new smaller-value notes (for example, 1,000 old dinars = 1 new dinar). Revaluation removes the zero while keeping the purchasing power equal to before. Iranian news confirms that it wants to revalue its money, yet does not want to revalue the Iraqi dinar. Without the Iraqi Dinar fraction, there will be no change in the foreign currency conversion standard of the Iraqi Dinar IQD. Market analysts also note that allowing any such expert price assessment, even through revaluation, would not benefit the Iraqi economy. Doing so would lead to various issues for Iraq:

- Inability to reimburse public liabilities due to revised assessment

- A blockade is imposed on unrecognized organizations entering Iraq for business.

- The far-reaching effects of the above generally resulted in limited development in the post-war period.

- The comparative Iraqi dinar revaluation of the Kuwaiti dinar is a gradual verification.

This rests on the conviction of some financial supporters that Iraq’s oil reserves and recovery potential make the Iraqi Dinar a good buy in 2024. Some economic proponents argue that the market could grow a solid appreciation for the Iraqi dinar post-war because the vast oil reserves will eventually make it reliable cash.

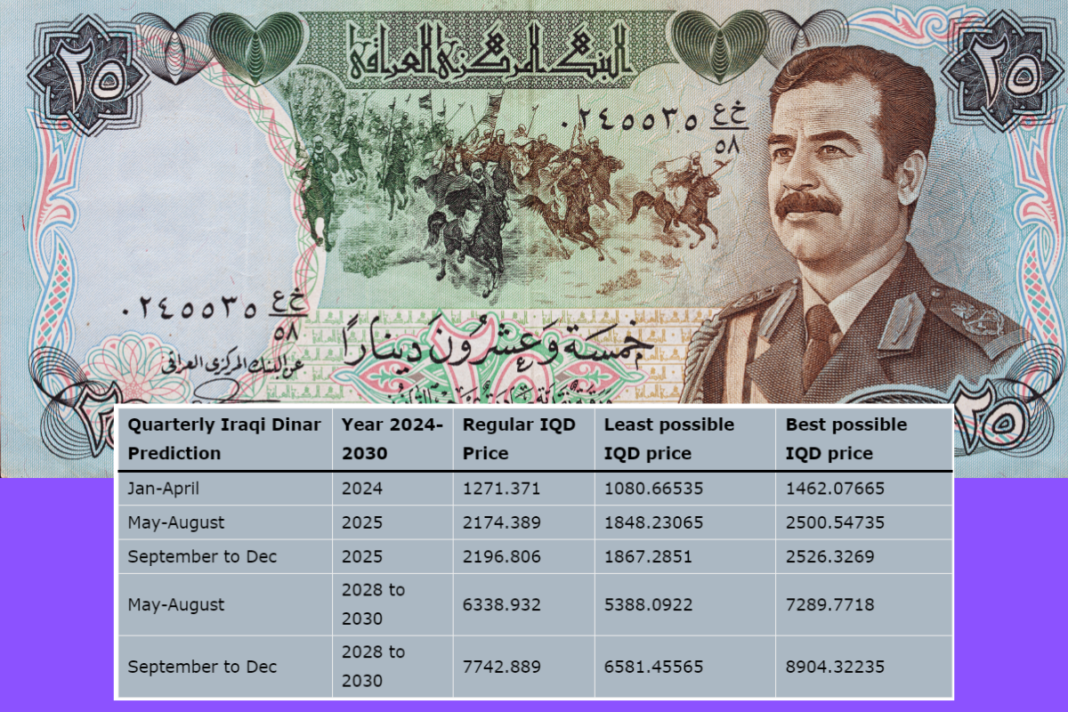

| Quarterly Iraqi Dinar Prediction | Year 2024-2030 | Regular IQD Price | Least possible IQD price | Best possible IQD price |

|---|---|---|---|---|

| Jan-April | 2024 | 1271.371 | 1080.66535 | 1462.07665 |

| May-August | 2025 | 2174.389 | 1848.23065 | 2500.54735 |

| September to Dec | 2025 | 2196.806 | 1867.2851 | 2526.3269 |

| May-August | 2028 to 2030 | 6338.932 | 5388.0922 | 7289.7718 |

| September to Dec | 2028 to 2030 | 7742.889 | 6581.45565 | 8904.32235 |

Investments in Iraq Dinar in 2025, 2030

In short, the future of the Iraqi Dinar is on par with any other investment if you exchange a specific amount of USD for a particular value of Iraqi Dinar. Iraqi Dinar Price 2025 is purchased from you like stocks, bonds and other forms of financial security. Then, you anticipate that the price increase will result in greater profits. This is how predictions are made on the future value of the Iraqi dinar. To believe that future projections of the Iraqi Dinar are a completely risk-free way of investing that offers better returns than is possible would be an example of childishness. These considerations also influence predictions of the Iraqi dinar.

Forex Basics for the Iraqi Dinar (IQD/UDS)

Foreign exchange is a method of exchanging monetary assets and cash. For example, the current exchange rate for one Iraqi Dinar (IQD/UDS) is approximately 1,160 IQD being exchanged for one US Dollar.

Consider the following scenario: You see the Iraqi Dinar’s prediction 2025 and decide to invest $1,000 in the Iraqi Dinar. As a result, you get 1.16 million Iraqi dinars. After first investing using future forecasts of the Iraqi Dinar, you can wait for an increase in the value of the Iraqi Dinar against the dollar.

Investment Considerations

In basic terms, it’s led similarly to any money venture. You buy ‘x’s measure of Iraqi dinar (IQD) by paying ‘y’ measure of U.S. dollars (USD). Again, as with purchasing stocks, bonds, or other money, you buy Iraq dinar 2021 at a given cost and anticipate that the price should rise shortly. Monetary tips usually have specific features; we have mentioned some of them below:

- Suppose the plan runs and is advanced by individual specialists rather than known intermediaries, monetary firms, different elements, or in case. In that case, there are substantial informal advancements through web/messages/selling calls rather than open and reasonable showcasing.

- On the off chance that advertisers guarantee misrepresented returns.

- Because of the Iraq dinar venture plot, there may be extra warnings: States like Utah, Oklahoma, and Alabama issue admonitions against such investments.

Long-term projections for Iraq’s economy, currency rates, and other variables are questionable. Furthermore, because global events are difficult to predict or control, currency trading on margin is always risky. Investors and dealers should exercise extreme caution when transacting in Iraqi Dinar or any equivalent currency unless transactions are conducted in regulated markets or through licensed agents.

References: Iraq’s future direct dollar earnings Forecast the exchange rate of the Iraqi dinar

What is the advertising opportunity for investors, and how does it relate to Iraqi Dinar’s future predictions?

Let’s check out the benefits of future predictions for the Iraqi Dinar:

Nevertheless, many institutions and organizations are considering investing in the Iraqi dinar based on future projections of its value. The information was from the latest updates regarding the Iraqi Dinar and the investment potential between IQD and USD. Before implementing measures to establish authority over its domestic market, the National Bank of Iraq took some actions. Before this, in April 2007, the IQD/USD exchange rate was valued at around 1,270. The price of the same item in August 2020 is around Rs 1,190. The Iraqi dinar has experienced positive market returns of 6.5%.

Is the value of the Iraqi Dinar increasing in the future prediction?

The value of the Iraqi dinar has increased significantly even though this increase has been gradual. The real revaluation of the Iraqi dinar demonstrates the development. The Iraqi Dinar 2021 has shown signs of recovery as the region become more stable and industrial and commercial activity resume. A good strategy to buy at a low price and eventually sell at a higher price is to invest resources in the Iraqi Dinar. This is a great way to buy at a lower price and sell at a higher price.