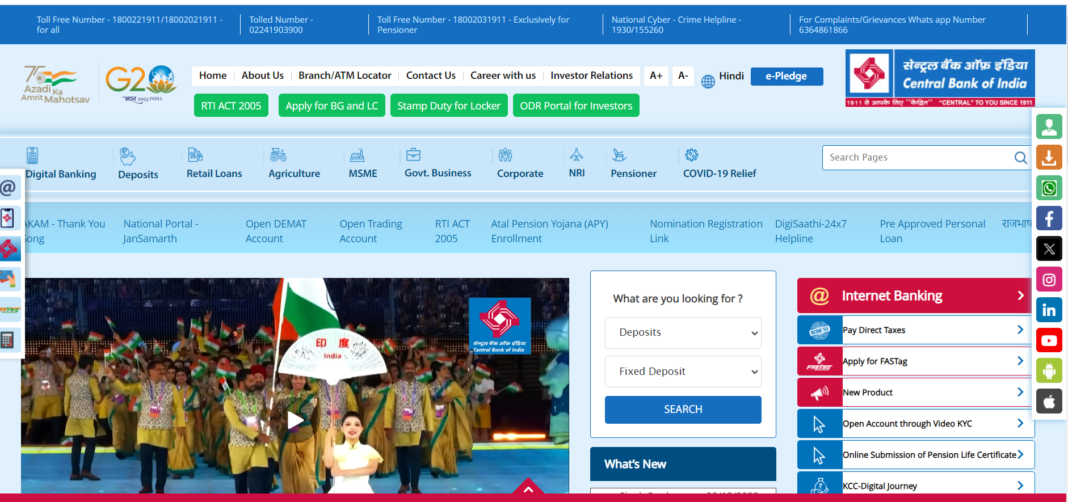

Nowadays, there are large crowds in every bank, including the main branch of the Central Bank of India. People do not like to visit there for banking services since they do not have enough time in their hectic schedules. So, they go to the nearest CBI CSP to deposit and withdraw cash in small sums.

Some individuals may believe that Customer Service Point is a scam; however, this is not true. The Central Bank of India builds CBI Kiosk Points with RBI authorization. As a result, all banking services are authentic and provided by a bank-certified employee.

What is Central Bank of India Kiosk Banking CSP?

If you live in a decent market location, have you ever noticed a little shop that offers financial services? If so, these are the bank’s customer service points. So, we can say that the Central Bank of India Kiosk Banking is CBI’s Customer Service Point, which serves consumers with CBI-related banking services.

When a CBI Kiosk Point is constructed in the region, locals will no longer need to visit their primary bank to deposit and withdraw cash. This is because they may effortlessly deposit and withdraw cash ranging from 500 to 10,000 rupees without wasting time.

Anyone who does not have a bank account can quickly open one by visiting the Central Bank of India Customer Service Point. Kiosk Banking is particularly beneficial to rural citizens because it deals with small sums of money.

The bank needs to select employees to work at the CBI Kiosk. Therefore, anyone over 18 and willing to invest a minimal amount of money can easily apply for the Central Bank of India CSP.

Highlights of Central Bank of India Kiosk Banking CSP

| Particulars | Kosik |

| Name of service | CBI CSP |

| Mode of application | Online |

| Benefices of scheme | Citizens of India |

| Objectives | Banking services to rural customers |

| Benefits | Had provided services to its main base |

What Is the Eligibility for CBI Kiosk Banking CSP?

To qualify for Central Bank of India Kiosk Banking, you must meet the qualifying requirements outlined below.

- The applicant must be a citizen of the retail area where he intends to open CBI CSP.

- You must be at least 18 years old.

- The minimum educational prerequisite is a 10th and 12th pass.

- Certificates require basic computer knowledge.

- You can easily apply for the Customer Service Point of the CBI.

- Retired government employees and army personnel can apply with ease. A minimum office space of 100 to 150 square feet is necessary.

What are the services provided by the Central Bank of India Kiosk?

CBI CSP offers all forms of banking service. If the bank is too far away, visit your local Central Bank of India BC Point. CBI Kiosk Banking provides the following services.

- New savings account opens with insurance advantages.

- ATM card issuing with incredible perks.

- Passbook to check your balance.

- Aadhar Card, Mobile Number, and PAN Card connecting to a bank account

- Easy Cash Deposit and Withdrawal

- Transferring funds internationally.

- Open new RD and FD accounts and benefit from insurance schemes.

- Loan facility for starting business and personal use.

Required Equipment for the Central Bank of India CSP Apply?

If you want to open a Central Bank of India kiosk, you’ll need certain equipment. We have mentioned the equipment required to build your own Central Bank of India Kiosk Bank.

- Two or three branded laptops or computers with Windows 10 installed.

- Reliable Wi-Fi connection and internet backup.

- Both coloured and black and white printers

- Scanner

- Safety drawers for storing cash, documents, and other items.

- Requirements include a counter, adequate furniture, and stationery items.

Documents Required to Apply for CBI Kiosk Banking

You must have certain documents in order to apply for the Central Bank of India’s CSP.

- Required documents: Aadhar card, PAN card, and 6 passport-sized pictures.

- Required documents include a driver’s license, electricity bill, ration card, proof of residential address, voter ID card, bank passbook, and shop lease agreement papers.

- Address Proof of Shop

How much does a Central Bank of India Kiosk Banking employee earn?

When you decide to operate a CBI Kiosk Point in your area, you will undoubtedly have questions regarding how to make money from this company. You should be aware that the corporation does not pay salaries to CBI CSP employees.

The Central Bank of India only charges a commission for each transaction or service you deliver to consumers. The bank will provide you between Rs. 10 and Rs. 50 when you open a bank account. Cash deposit and withdrawal operations earn you between 0.02% and 0.06% fee on the transaction amount. Allows you to make Rs. 15 to Rs. 20,000 every month.

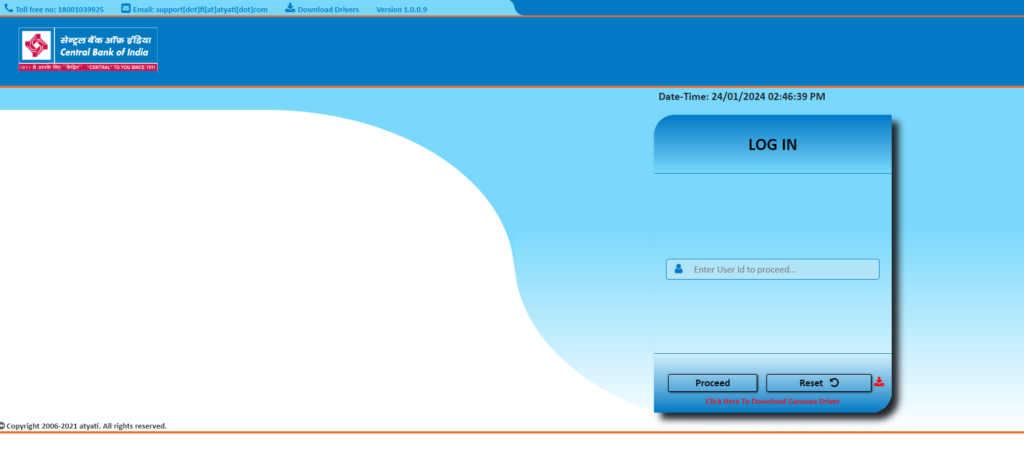

Apply to Central Bank of India Kiosk Banking

The application for the CBI Kiosk is quite simple. You may easily obtain a Kiosk form by visiting the bank. After receiving the Bank Kiosk form, complete it by entering the necessary information and attaching a photo of your passport-size to the front. Fill out the form and submit it to the bank with the other required documents.

After some time, you should speak with the Bank Manager and ask him to assist you in obtaining CBI Bank CSP. They will verify your documentation, equipment, and space; then, you will acquire the license to open the Central Bank of India Kiosk.

Best CBI banking CSP provider companies in India

If you are looking for the best CSP providers in India for CBI banking, you can find various companies online. However, you must be aware of the frauds. Here are some of the reliable and the best CSP providers in India:

- Kiosk Bank

- Digital India CSP

- AISECT

- Bank Mitra

- My Oxygen

With enough qualifications, you can easily open a Central Bank of India CSP in your community without investing much money.

You don’t need to look for a job in other cities if this is the ideal option for your work. If you are serious about opening a CBI Kiosk, you must complete the entire process, including arranging the relevant documentation and equipment.